Payment gateways provide the service to process online payments from customers to merchants securely. When integrated with any ecommerce website, the role of payment gateways is to allow customers to pay for their online purchases using either credit or debit cards or via online banking smoothly.

Here’s a look at some of the best Malaysia payment gateway providers used by the majority of Malaysian online sellers.

You’ll find the best payment gateway in Malaysia comparison chart at the later part of this article.

PayPal

PayPal is well known internationally as it’s widely used by both local and international sellers.

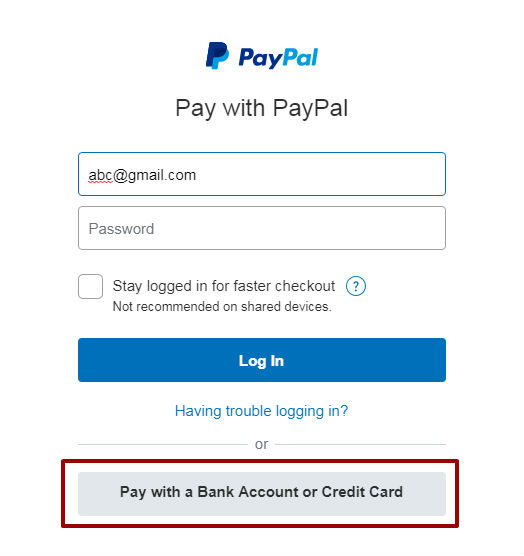

Customers DO NOT NEED to have a PayPal Malaysia account to make payment on a website that is using PayPal as their payment gateway processor.

Customers can just use their credit or debit card when they land on PayPal’s site during the checkout process by clicking the “Pay with credit card” link.

PayPal is a flexible payment gateway Malaysia that is both popular and easy to manage.

PayPal Malaysia does not require any sign up fee or yearly fee to use their online credit card processing Malaysia feature making it highly recommendable for new startups to begin accepting credit / debit card payments from customers immediately.

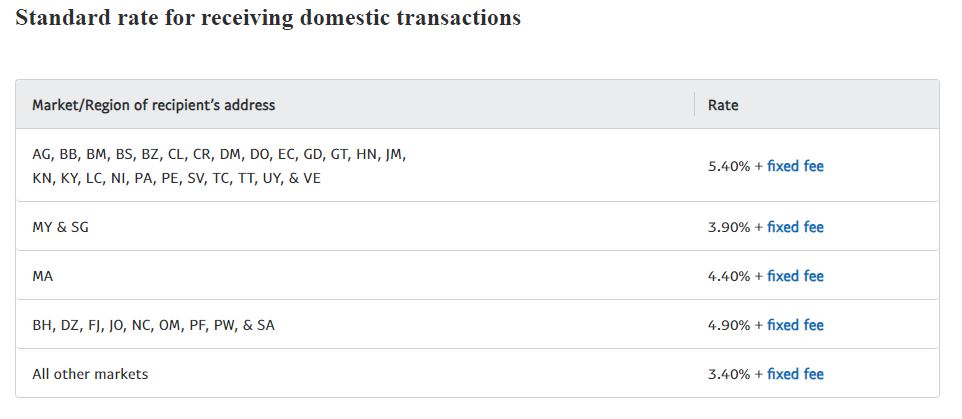

However, please note that while PayPal is easy to set up and use, their transaction fee is 3.9% + RM2 for credit / debit card online transactions for Malaysian customers whereas international customers buying from you will be charged at 4.4% + RM2 per transaction.

However, setting up a PayPal Malaysia account to accept payment is easy and fast.

Just go to PayPal Malaysia’s site and sign up for a business account.

Key in your details and remember to link your PayPal account to your online store to start accepting online payments.

Here’s how to link your InstanteStore to PayPal.

PayPal Malaysia does not offer FPX online banking.

You’ll need to transfer the funds from your PayPal account to your local bank account.

If the amount is less than RM400, there’s a RM3 charge by PayPal. There’s no charge if the amount is RM400 and above.

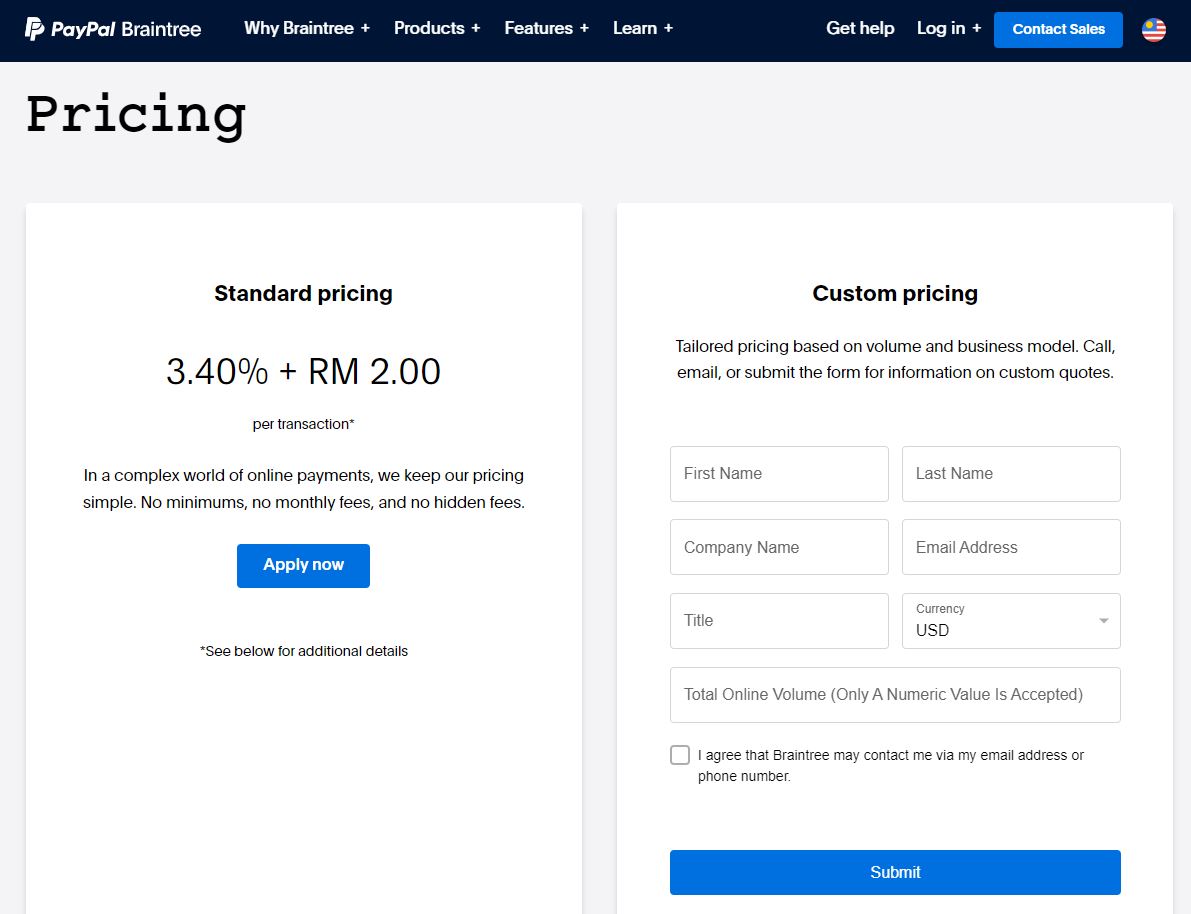

Braintree

Braintree is an ecommerce payment gateway that was acquired by PayPal in 2013 with the goal of propelling the payment platform on a global scale.

All kinds of businesses use Braintree to accept payments in mobile apps and websites as they have experience working with new business models.

Merchants in Malaysia can accept PayPal, Apple Pay, Android Pay, and cards on the Visa and Mastercard networks as long as the cards are enabled for online use.

Please note there’s a RM90 flat rate for chargebacks.

Signing up for a Braintree Malaysia account may take a bit of time as the company requires your business registration details (Malaysian IC, Business Registration Forms, Utility Bills with business registered address, Malaysian Bank Account Statement that is registered with the business, etc) to verify that you’re a valid legal business before opening a Braintree account for you.

The good thing about Braintree is that they offer a lower credit / debit card transaction fee (3.4% + RM2) compared to PayPal (3.9% + RM2) and that all payment is pushed to your local bank account on a daily basis.

And like PayPal, Braintree does not charge any Setup Fee or Yearly Fee at all.

Braintree Malaysia does not offer FPX online banking.

Braintree will automatically push all payment amount to your local bank account on a daily basis with no minimum amount.

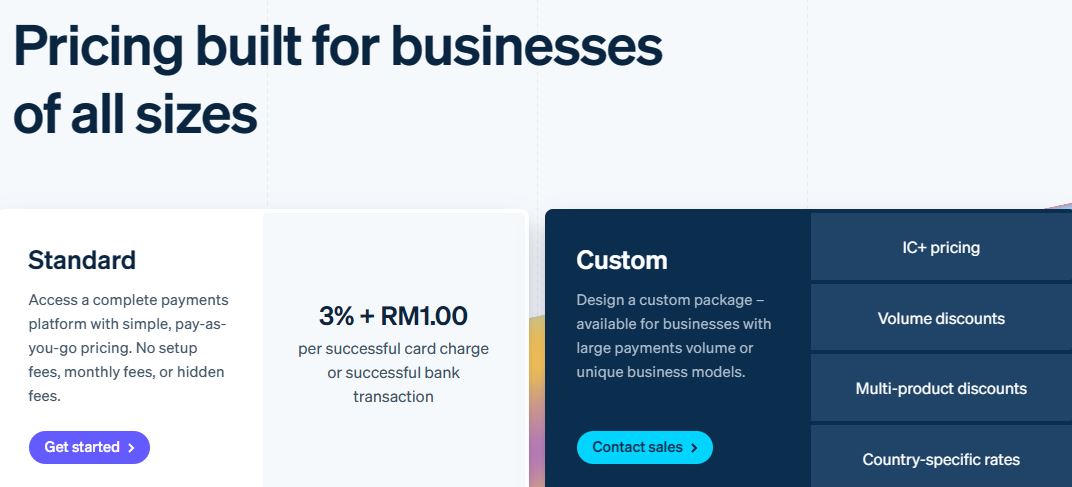

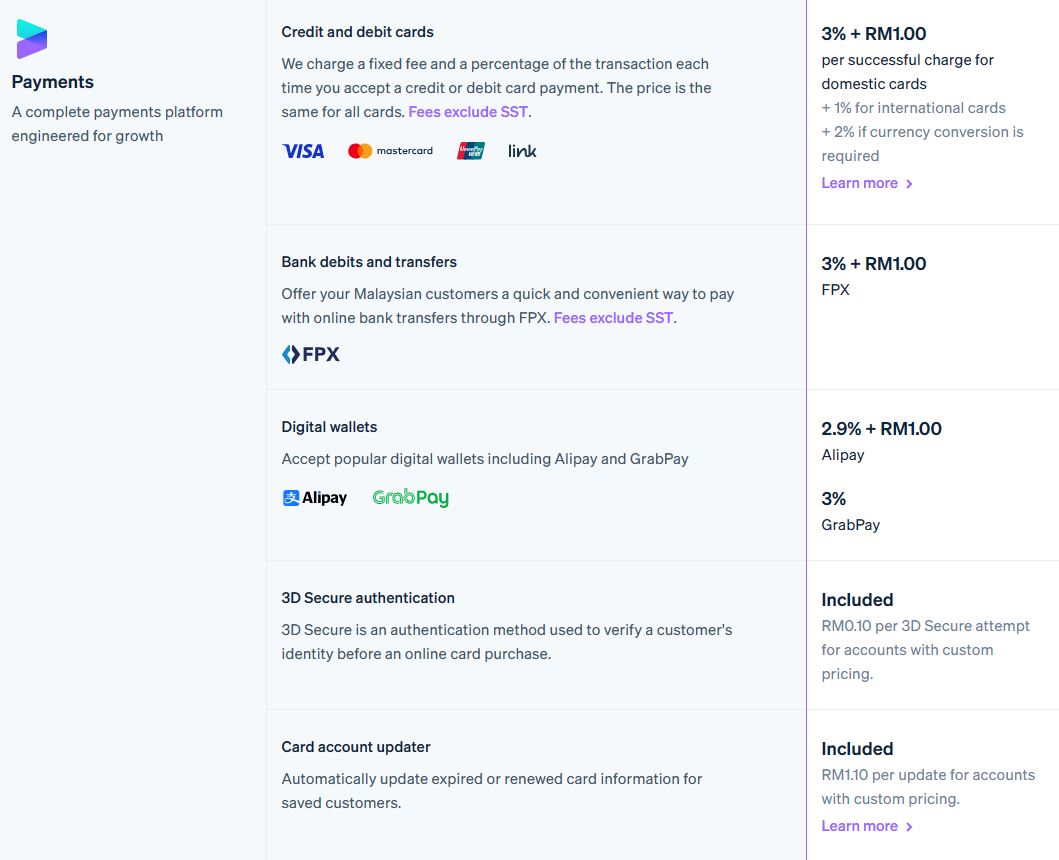

Stripe

Stripe is an international payment gateway provider that is somewhat similar to PayPal in which there’s no Setup Fee or Annual Fee charged for opening a merchant account with them.

You can have your own account set up within minutes with them.

Stripe’s pricing is definitely better than PayPal or Braintree at 3% + RM1 per transaction.

However, with international payment gateways, transaction fees tend to be higher compared to our own Malaysian payment gateway providers.

Here’s the rundown :

Local Credit / Debit card for Visa/Master : 3% + RM1

Foreign credit card for Master/Visa : 4% + RM1

IF Currency conversion is required : additional 2%

Online Banking (FPX) : 3% + RM1

GrabPay : 3%

AliPay : 2.9% + RM1

Here’s How To Setup Stripe Account For Ecommerce – a step by step guide.

If you’re planning on accepting a lot of foreign credit / debit card transactions to your local Malaysian website, the cost in transaction fees is going to add up to a big sum especially when currency conversion is required to convert into Malaysian Ringgit.

Please note that there will be a RM90 charge per dispute (also known as chargebacks for card transactions).

iPay88

iPay88 is one of Malaysia’s leading payment gateway ecommerce providers.

Their headquarters is located in Kuala Lumpur, Malaysia and they have a presence in Cambodia, Indonesia, the Philippines, Thailand and Singapore.

iPay88 was acquired by NTT DATA, a Japanese system integration company in 2015 and continues to strengthen their presence in the ecommerce and mobile commerce field in the whole of South East Asia.

iPay88 Malaysia offers 3 different plans to meet your business needs.

If you’re only looking for a payment gateway for online store in Malaysia FPX feature to accept payment via online banking and e-wallets from customers, then you can consider iPay88’s SME Plan. It comes with a one time Setup Fee of RM488 (wef 20 March 2020).

Bear in mind their FPX rate for the Start Up Plan is 2.7% or RM0.60 per transaction whichever is higher.

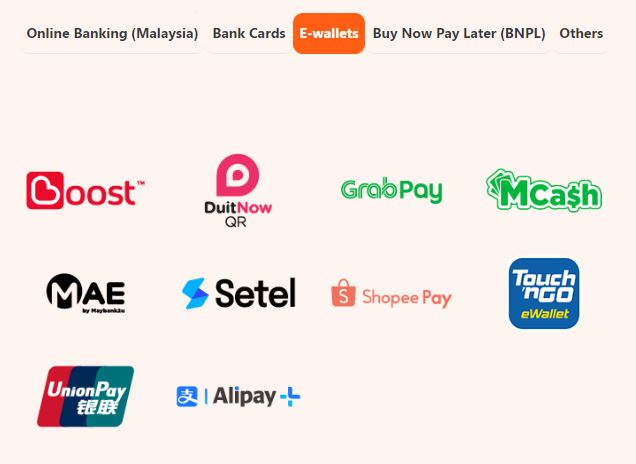

Their SME Plan comes with online banking, credit / debit card (UnionPay at 2.7%) and e-wallets.

Their Enterprise Plan offers online banking, credit/debit card processing (Visa/Master/UnionPay) and e-wallets.

For credit card processing (Visa/Master/UnionPay), they’ll be using local banks to process those payments at a lower transaction rate (2.3%) while debit card (Visa/Master) is at 2% which is better than you using a direct PayPal account (3.9% + RM2 per transaction).

Their Enterprise Premium Plan are comes with a Setup Fee of RM2888 and a yearly maintenance fee of RM700.

These 3 plans come with a Setup Fee of RM488, RM1888 and RM2888 respectively.

Merchants who choose their SME Plan will have to pay RM500 for Annual Fee and RM600 Annual Fee for the Enterprise Plan while the Credit Card Application Fees of RM900 is waived by iPay88 for all 3 plans.

All 3 plans include e-wallets Boost (1.5%), MBBQR (1.5%), GrabPay (1.5%), TouchnGo (1.5%), ShopeePay (1.5%), NetsQR (1.5%) and MCash (1.5%).

For those who wish to add on AliPay, there will be an additional Setup Fee of RM1000 (IF getting with any iPay88 plan) and Annual Fee of RM500 (IF choosing only standalone AliPay).

iPay88 will pay out twice a week to your local bank account but the minimum amount in your iPay88 account must be RM10 for them to do so.

eGHL

eGHL was founded in 2013 and functions as an internet payment arm of GHL Systems Berhad.

You’ll notice quite a number of physical card payment terminals in physical stores and retail are using GHL as their credit / debit card payment processor.

So it comes as no surprise that the company entered the ecommerce payment gateway market with their internet payment arm, eGHL.

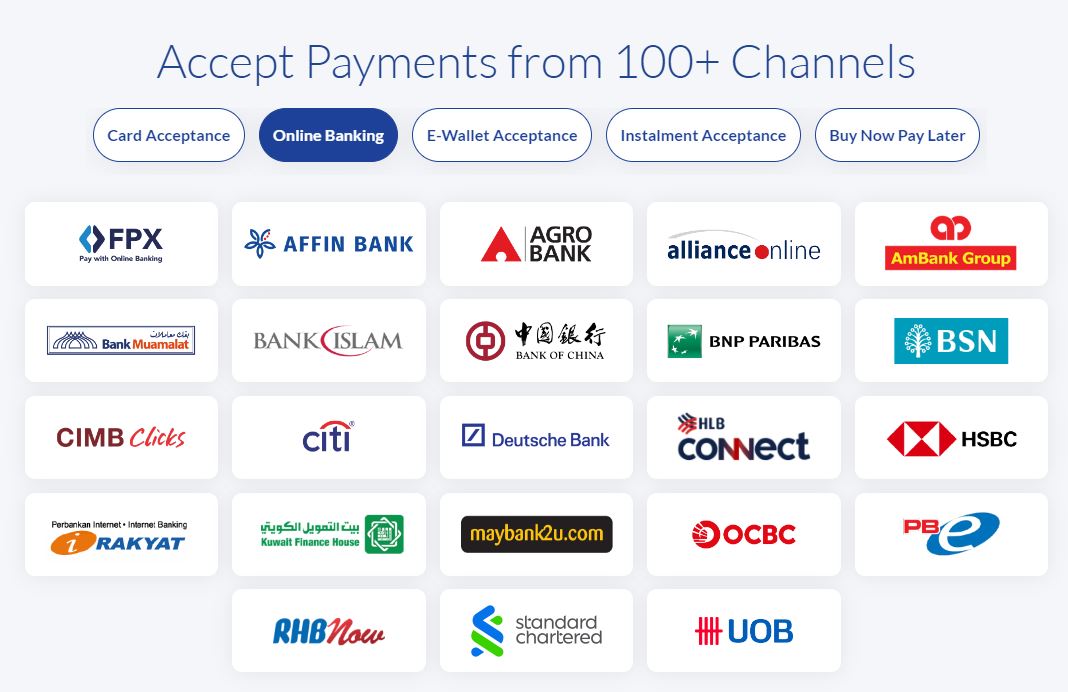

eGHL is a Malaysia payment gateway that offers a secure internet payment solution which covers both card and non-card payment channels for online businesses throughout the South East Asia region.

eGHL offers a lower transaction fee for credit / debit card (1.4% – 2.4%) and FPX payments (1.6% – 2.4% or RM0.60 whichever is higher) depending on the plans you take.

They have 3 plans to meet your business needs : Standard / Premium / Corporate which charges a Setup Fee of RM499 / RM2500 / RM 5000 that you need to pay when you sign up with them. Please note that the fee is subject to 8% SST (wef 1st March 2024).

Startups which choose the Standard and Premium plan will need to pay a Monthly Fee of RM25 + 8% SST per month IF total monthly transactions are less than RM15k for the month.

Starting from 1st March 2024, eGHL has switched to charging their merchants a Monthly Fee instead of the usual Annual Fee. Those who are on the Corporate Plan will need to pay RM50 per month.

eGHL is an excellent payment gateway provider to consider if your business has consistent growing volume to justify the Monthly Fee while you enjoy lower transaction fee for credit / debit card and FPX payments.

Here’s a rundown of their 3 plans with e-Wallet rates (wef 27 February 2024) :

Standard Plan

Credit / Debit card for Visa/Master : 2.4%

+ 1% for non-MYR processing

+ RM0.50 (for transactions less than RM40)

Online Banking : 2.4% or RM0.60 (whichever higher)

Boost, MCash, GrabPay, TouchnGo, ShopeePay : 1.5%

Maybank QRPay (MAE) : 1%

Monthly Fee : RM25 + 8% SST per month (waived IF total monthly transaction volume more than RM15k per month upon request)

Premium Plan

Credit card for Visa/Master : 2.0%

Debit card for Visa/Master : 1.8%

International Credit/Debit for Visa/Master : 3%

+ RM0.50 (for transactions less than RM40)

Online Banking : 2.0% or RM0.60/transaction OR Fixed Rate RM1.50/transaction

Boost, MCash, GrabPay, TouchnGo, ShopeePay : 1.3%

Maybank QRPay (MAE) : 1%

Monthly Fee : RM25 + 8% SST (waived IF transaction volume exceed RM15k per month upon request)

Corporate Plan

Credit card for Visa/Master : 1.6%

Debit card for Visa/Master : 1.4%

International Credit/Debit for Visa/Master : 3%

+ RM0.50 (for transactions less than RM40)

Online Banking : 1.6% or RM0.60/transaction OR Fixed Rate RM1.00/transaction

Boost, MCash, GrabPay, TouchnGo, ShopeePay : 1.2%

Maybank QRPay (MAE) : 1%

Monthly Fee : RM60 + 8% SST (waived IF transaction volume exceed RM15k per month upon request)

Processing Fee for all 3 plans

Refund : RM0.50 per transaction

Chargeback : RM5 per transaction

Settlement : No charge to Malaysian local bank, USD30 to Foreign Bank

eGHL offers GrabPay Postpaid, GrabPay BNPL Installment and Atome BNPL as optional add-ons for FREE.

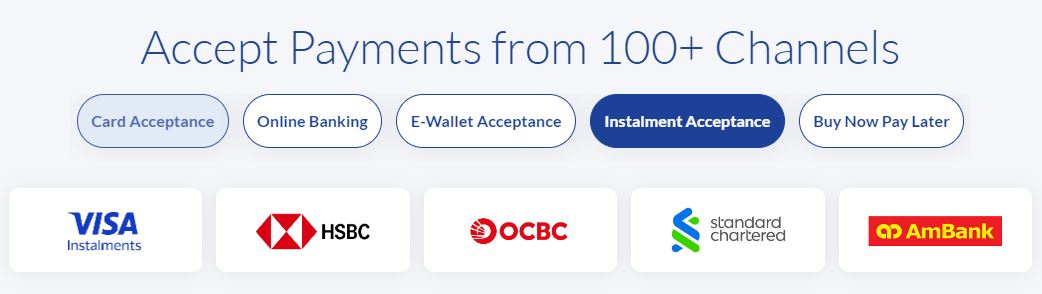

They also offer Visa Installments option for FREE with HSBC Bank with the following rates :

3 Months – 2.65% per transaction

6 Months – 3.0% per transaction

9 Months – 3.5% per transaction

12 Months – 4.0% per transaction

18 Months – 5.0% per transaction

24 Months – 6.0% per transaction

36 Months – 8.0% per transaction

The Visa Installment Plan will be offered with Standard Chartered Bank and AmBank soon as well.

Payments are pushed to your local bank account on a weekly basis with no minimum amount requirement.

Kiple Pay

KiplePay is one of the fastest growing ewallet in Malaysia. Their mission is to be the market leader for FinTech in an increasingly cashless, tech-powered society.

KiplePay is owned by Green Packet Berhad which is an established multinational digital technology organization with expertise in telecommunications, media and technology.

Green Packet was founded in California’s Silicon Valley in 2000 and was listed in the Malaysian Stock Exchange in 2005.

Kiple Pay offers one SME Plan for online merchants which is pretty simple and straightforward.

SME Plan

Credit card for Visa/Master : 1.5%

Debit card for Master/Visa : 1%

Foreign credit card for Master/Visa : 2.5%

Online Banking (FPX) : RM1

Boost, KiplePay, Maybank MAE, GrabPay, TouchnGo, ShopeePay, WeChatPay, AliPay : 1.5%

Setup Fee : RM500

Annual Fee : RM500 (first year WAIVED)

Billplz

Billplz is another Malaysian payment gateway that has been gaining lots of traction lately with their no frills online payment gateway service.

The difference between them and other Malaysian payment gateways is that they do not charge any Annual Fee or Setup Fee for their Basic Plan which is a big help for Startups who are starting to sell online for the first time with their own website.

However, they do charge a Per Payment Order Fee of RM1.10 and RM0.70 and a Billing API Fee of RM0.60 per SMS for their Basic and Standard Plan.

These charges are on top of the FPX Fee that merchants will need to pay if clients use Online Banking or when they make any payment with credit / debit card or eWallets.

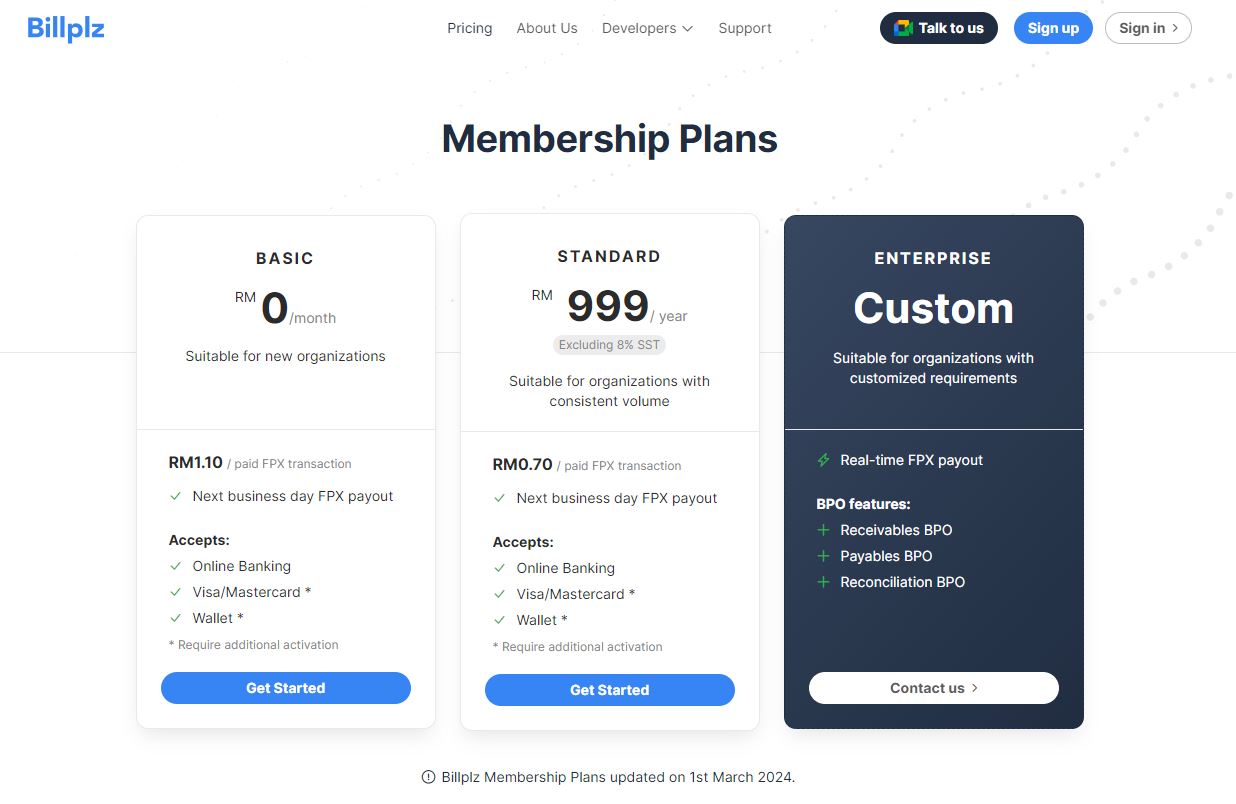

Billplz offers 3 membership plans for merchants to choose from :

Basic Plan

Credit card for Visa/Master : 1.8%

Debit card for Master/Visa : 1%

Foreign credit card for Master/Visa : 4.4%

Online Banking (FPX) : RM1.10

Per Payment Order Fee : RM1.10

Billing API : RM0.60 per SMS

Setup Fee : FREE

Annual Fee : FREE

Standard Plan

Credit card for Visa/Master : 1.8%

Debit card for Master/Visa : 1%

Foreign credit card for Master/Visa : 4.1%

Online Banking (FPX) : RM0.70

Per Payment Order Fee : RM0.70

Billing API : RM0.60 per SMS

Setup Fee : FREE

Annual Fee : RM999 + 8% SST (wef 1st March 2024)

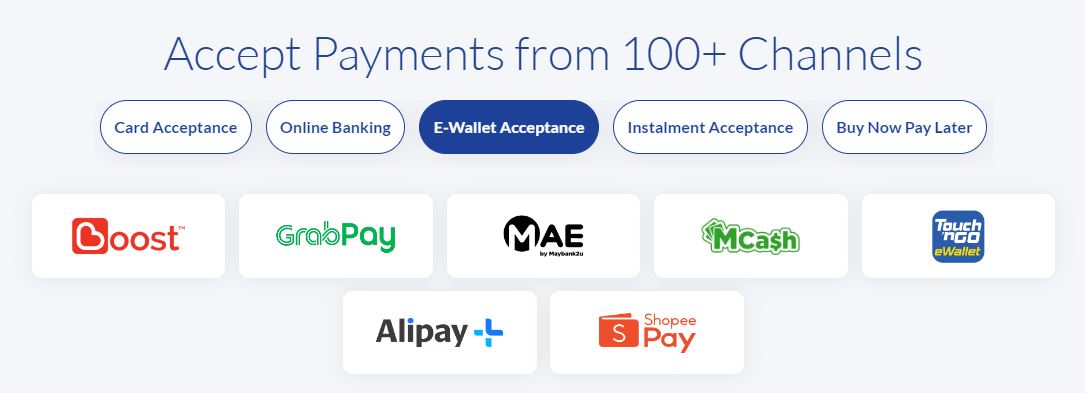

eWallet Rates

MaybankQRPay : 1%

ShopeePay : 1.1%

TouchnGo, GrabPay : 1.2%

Boost : 1.4%

Shopify Transaction Fee : 0.3% (charged by Shopify)

For Buy Now and Pay Later :

Grab Pay Later : 6.5% for 1-4 monthly installments

Atome : 6% for 3 monthly installments

Their Enterprise Plan is subject to Bank’s Offer.

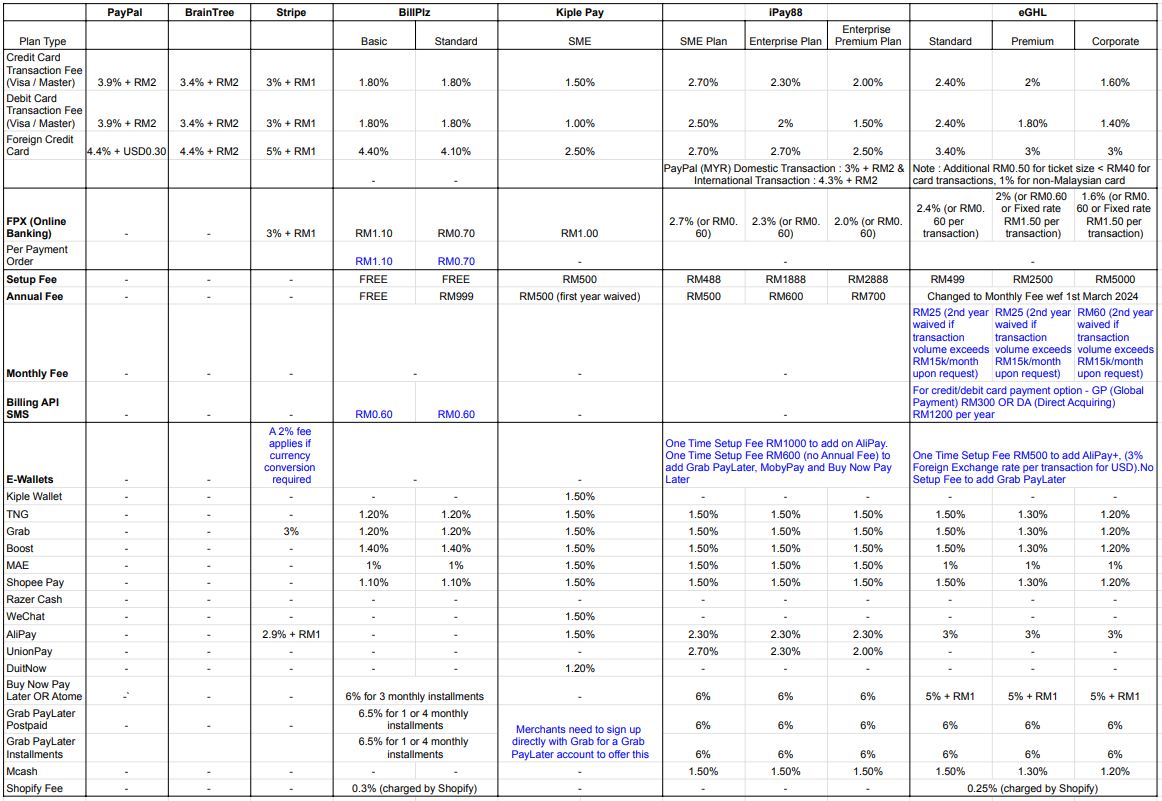

Best Malaysia Payment Gateway Comparison Chart

The Best Malaysia Payment Gateway Comparison Chart gives an overview of the payment gateway Malaysia fees for credit / debit card and FPX online banking, set up fees, yearly fees and minimum withdrawal amount to local bank account giving new and existing merchants the choice to sign up or switch to different providers.

Merchants who are interested to enjoy the transaction rates mentioned can contact us and we will help them register for a new account with the respective Malaysia payment gateways.

For Ecommerce Startups And New Businesses

For startups and new businesses who are very budget conscious, we would normally recommend that they sign up with a PayPal direct account or Stripe first while pending their application for any of the payment gateway providers of their choice.

Most like the word ‘FREE’ so they’ll usually go for the Billplz Basic Plan where they do not need to pay any set up or yearly fee while enjoying access to both credit / debit card processing, FPX Online Banking and eWallets.

For Ecommerce Sites With Volume Transactions

For ecommerce businesses that have a considerable amount of daily, weekly and monthly volume transactions, they would usually go for Kiple Pay as they offer one of the lowest credit / debit card and FPX transaction fees.

The other option would be eGHL where those businesses have both an ecommerce and physical presence as eGHL offers a range of payment processing features across different channels.

Which Payment Gateway Options In Malaysia Should I Choose?

The best Malaysia payment gateway provider really depends on the merchants’ business needs.

If you want something fast and ‘free’ without the hassle of paying setup fees and yearly fees, PayPal Malaysia, Braintree Malaysia, Stripe and Billplz’s Basic Plan are suitable.

If you have a tonne of transactions to process for both online and physical retail, then Kiple Pay and eGHL will be able to meet those needs.

Regardless of volume transactions, it’s vital that any ecommerce business must have an online credit card processing Malaysia feature on their site as majority of buyers prefer to pay with credit / debit cards.

This payment gateway Malaysia comparison chart acts as a guide for new and existing sellers to consider which Malaysia payment gateways can best meet their business needs.

If you have any question or feedback about the mentioned payment gateways, please reach out to us at InstanteStore as we’re constantly working to help businesses sell more online.